salt tax deduction california

1 day agoTo partially offset the tax cuts the TCJA imposed a cap of 10000 on the amount of SALT that can be deducted each year at the federal level. The trend among states to adopt elective pass-through entity taxes or PTETs.

Crescent Bay Cove In Laguna Beach Ca Laguna Beach Tide Pools California Vacation Laguna Beach California

As the first Tax Day without unlimited state and local tax deduction approaches an estimated 1 million California families will pay 12 billion more to Uncle Sam.

. July 29 2021. California SB104 seeks to. While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step toward allowing many of its.

New law applicable to tax. The California Elective Pass-Through Entity Tax Provides Business Owners a Salt Cap Tax Credit Workaround. Enacted by the Tax.

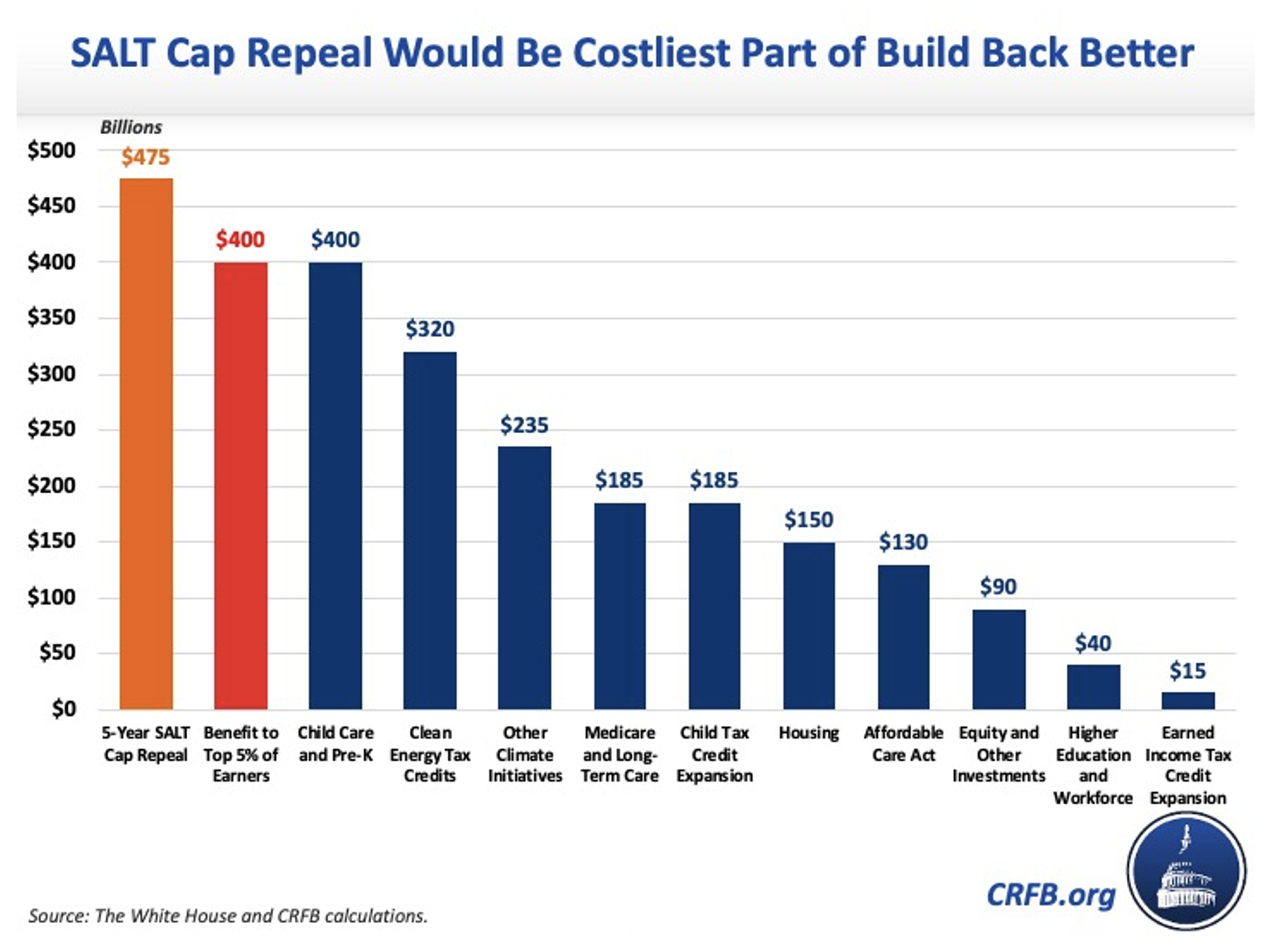

The large CPA firm Grant Thorton reported that On July 16 2021 California Gov. For many suburban homeowners 10000 doesnt even cover the annual real estate tax bill much less the state and local income taxes. That households so high on the income spectrum can expect a net tax cut from the Build Back Better Act is entirely due to the increase in the SALT deduction cap from 10000 to 80000 the.

July 16 2021. The 10000 cap was to remain in effect until 2025. 150 which contains the Small Business Relief Act creating an elective pass-through entity PTE level tax available to certain.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted elective pass-through entity PTE tax legislation. And there is a max 10000 limit 5000 MFS of property tax and state taxes SALT. SALT is State And Local Tax.

Governor Newsom signed California AB 150 allowing owners of passthrough entities exception to 10000 federal cap on state and local tax SALT deductions for individuals. Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers. California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and local taxes paid for individuals that was established by the Tax Cuts and Jobs Act of 2017 TCJA.

Which includes property tax any state tax paid like for last years return and includes any state withholding from your W2s and any 1099s you have. Now SALT deductions are capped at 10000 the same for single and married taxpayers. In a progressive state with high taxes many are discovering the bite the 10000 SALT cap is.

The qualified taxpayer must make an annual election on a timely filed original tax return to pay an elective tax at a flat rate of 93 of the qualified net income for the taxable year. According to the Tax Foundation the. For example if the business has 1000 of profit income they would first pay 93 dollars in quarterlies as an elective tax and then receive a tax credit on the elected tax.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. SB 113 which Governor Gavin Newsom signed into law on February 9 2022 expands the states workaround of the federal deduction limit for state and local taxes SALT and repeals the net operating loss NOL suspension and business credit limits. Effective for tax years 2021-2025 the Small Business Relief Act provisions of AB.

On July 16 th the Governor signed AB 150 a budget trailer bill containing language outlining Californias PTE tax. Like other SALT workarounds Californias. Then in December 2017 The Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 thereby limiting a taxpayers itemized deductions and tax benefits.

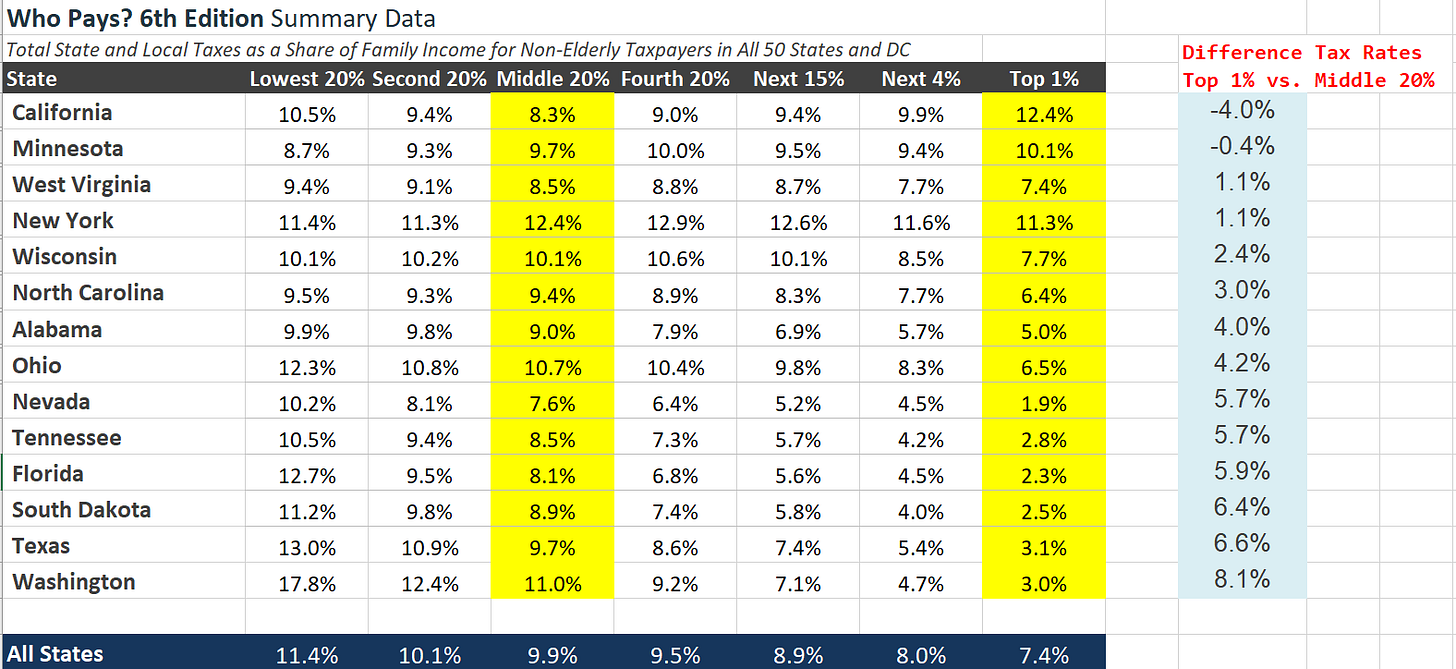

Finally another consideration is whether the combined federal state and local tax burden is reasonable for the states most affected by the SALT deduction. Gavin Newsom signed Assembly Bill 150 AB. 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either.

For many Californians and other taxpayers located in high-tax states like New York. In 2014 3386 of California returns included a deduction for state and local taxes. Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000 federal deduction limit for state and local taxes the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act or TCJA.

The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California. Before the 2018 tax changes taxpayers who itemized their deductions were able to deduct the full amount paid in SALT taxes each year essentially avoiding paying taxes on their tax payments. And any taxes in W2 box 14 and 19 like SDI or VDI.

The California SALT workaround helps a qualified taxpayer receive the tax benefit through a tax credit in the amount of PTE tax paid on their respective return. For California taxes the business owner who opts in to the California SALT deduction workaround which exists as an elective tax option would receive a credit for 949 of the amount of elective tax paid. This article provides an overview of the California Pass-Through Entity Tax PTE which CPAs need.

California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes known as SALT limitation with the enactment of AB150 recently signed by Governor Gavin Newsom. On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass-through entities PTE from the current individual annual 10000 limitation on the deduction against federal taxable income for state and local taxes SALT paid. The Tax Cuts and Jobs Act passed in 2017 limits an individuals annual federal deduction for SALT paid to 10000 for tax years 2018 through 2025.

California Enacts SALT Workaround. California Passes SALT Cap Work-Around.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

California And The Case For Restoring The Salt Deduction

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

Pin By Usama Sweet Osaim On Wallpaper And Beautiful Places Fashion And Beauty Tips Beauty Hacks Fashion Beauty

5 Tax Deductions Entrepreneurs Need To Know Business Blog Money Blogging Blog Tips

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

Trio Master Plan Master Plan Modern Architecture Building How To Plan

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

Royal Residence Compound Architecture Model Royal Residence Architecture

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Photo By Jason Chen Unsplash Taiwan Travel Singapore Travel Taipei